Unleashing Profit: The Importance of VAT Computing

Value Added Tax represents an essential aspect of various businesses globally. It functions as a significant source of revenue for governments while at the same time impacting the financial health of organizations. Understanding how to accurately calculate VAT is essential for maintaining compliance and securing profitability. In the current competitive marketplace, disregarding the intricacies of VAT can lead to costly mistakes that threaten a company's financial stability.

Many entrepreneurs and company owners may undervalue the importance of a reliable VAT calculation. A VAT calculator can be a key tool in simplifying this frequently complicated process. By efficiently calculating VAT, businesses can confirm they are charging the correct amount on products and services, properly managing their cash flow, and preventing potential penalties. Ultimately, acquiring expertise in VAT calculation is not just about compliance; it is a calculated strategy that can help unlock greater profitability and foster sustainable growth.

Comprehending VAT Computations

Value Added Tax, commonly referred to as VAT, constitutes a consumption tax levied on the transaction of products and service offerings. Understanding how VAT works is essential for businesses of different scales, as it directly impacts pricing policies, cash flow, and financial health. Each deal in the logistics chain is liable to VAT, which indicates accurate calculation is imperative to ensure adherence with tax laws and prevent penalties.

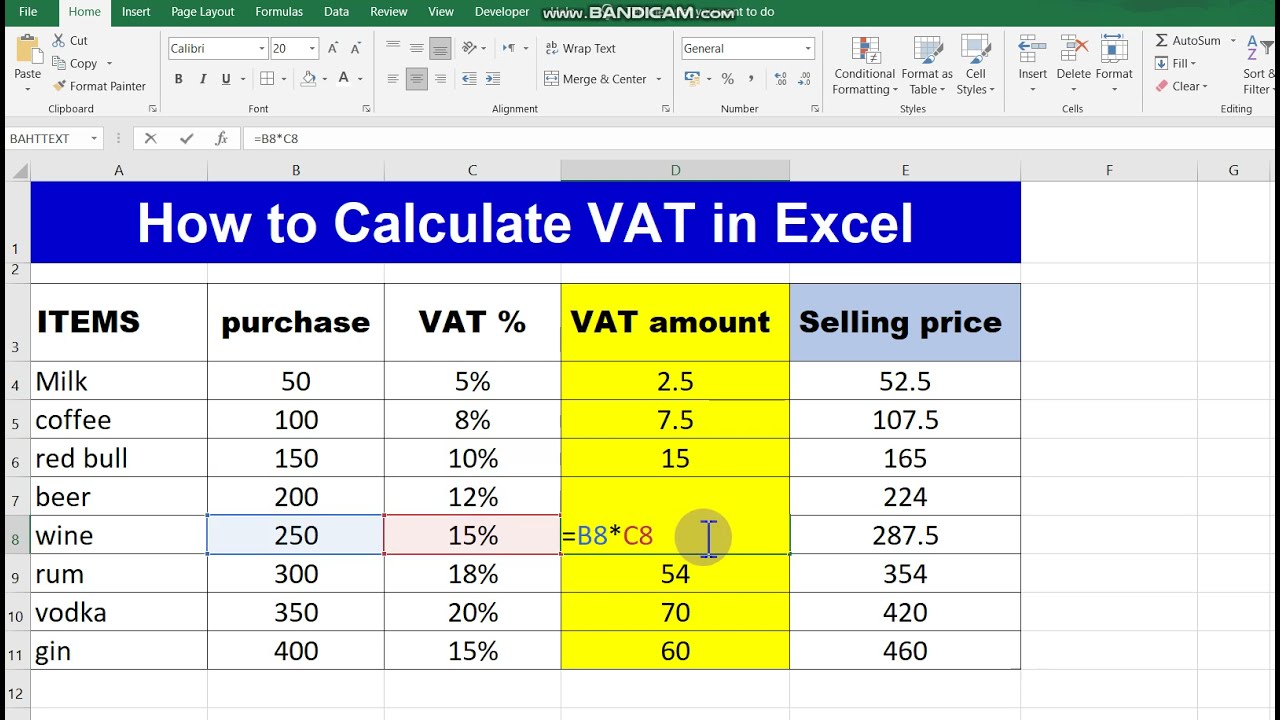

The method of calculating VAT starts with determining the right VAT percentage applicable to the item or offering offered. Several nations may have varying rates and exceptions, so it is essential for businesses to remain aware about the regulations that apply in their locality. This ensures that the company asks for the appropriate amount of VAT to clients and can recover tax credits on eligible purchases.

Using a VAT assessment tool can ease this process considerably. These resources enable companies to swiftly and precisely calculate the VAT sums owed or reclaimable, saving time and reducing inaccuracies. By establishing an optimized VAT calculation plan, companies can improve their fiscal management and confirm that they stay in the game in their sector.

Benefits of Using a VAT Calculator

Using a VAT calculator can greatly ease the process of determining the correct amount of VAT due on sales. For organizations, this means minimized time spent on manual calculations, lowering the risk of errors that could lead to fines or excess payments. A trustworthy VAT calculator considers the up-to-date rates and regulations, guaranteeing that businesses always operate within legal parameters and avoid the issues of incorrect VAT submissions.

Moreover advantage of employing a VAT calculator is its ability to improve cash flow management. By correctly calculating VAT on sales and purchases, businesses can more effectively understand their responsibilities and anticipated tax liabilities. This understanding allows for more informed decision-making regarding pricing policies, investment prospects, and budgeting. Knowing the specific VAT amount owed can help businesses maintain healthier cash flow and make the right decisions at the right time.

Ultimately, using a VAT calculator aids in better record keeping and reporting. Correct records of VAT calculations are vital for preparing financial statements and tax returns. A VAT calculator often generates thorough reports that can be easily integrated into accounting systems, facilitating the reporting process. calculate vat makes tax filing easier but also equips businesses with information into their VAT activities, helping them to plan more effectively for the upcoming period.

Common Mistakes in VAT Calculation

A typical common mistake businesses make is failing to maintain detailed records of their sales and acquisitions. Neglecting to record these transactions can lead to miscalculating the VAT payable or refundable. This error often results from inefficient methods or inadequate accounting systems, causing differences that may attract audits or penalties. It’s essential to establish a reliable system for tracking business activities to ensure accurate VAT determination.

Additionally, another frequent error is failing to understand the VAT percentages applicable to different goods and services. Many businesses believe that each good fall under the default VAT percentage, but certain items are liable for reduced or zero rates. This misunderstanding can lead to overcharging customers or underreporting VAT, damaging both public image and profitability. Keeping updated about applicable VAT percentages and adjusting where needed with the use of a vat calculator can assist in avoiding these errors.

Lastly, certain companies overlook the necessity of prompt VAT filing. Delaying filings can lead to fines for tardiness and additional costs, which can add up swiftly. It's crucial for businesses to be well-organized and prepared with their VAT due dates, making sure they calculate and submit their VAT filings on time. Using a vat calculator can facilitate this process and lessen the chance of errors linked to manual calculations in urgent situations.